Jan 22, 2021

The streaming business buzzword you need to know for 2021 is "churn."

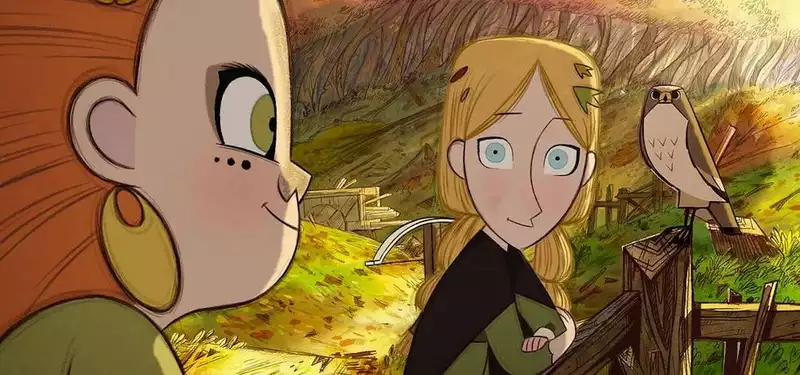

In December, the launch of "Wolfwalkers" on Apple TV+ sparked a bit of discussion on social media. Apple's young streamers have few prestige animated titles, and some of those who wanted to see Cartoon Saloon's new feature complained about having to sign up for a service that otherwise did not suit their tastes. Others suggested a solution: sign up for a free trial of Apple TV+, watch "Wolfwalkers," and then cancel their subscription without paying a penny.

In a nutshell, it is this kind of scenario that streaming distributors will increasingly have to face, according to a new report from Deloitte. The consultancy argues that the era of parallel growth for streaming distributors may be coming to an end (in the U.S.). Instead, the industry is seeing an increase in "churn" (the technical term for the tendency of customers to stop using a service). Consumers are becoming more fickle.

The report is based on three surveys conducted by Deloitte in 2020. According to these, between January and October, the average American who subscribes to a streaming service increased the number of paid subscriptions from three to five. But while only 20% of respondents in the January survey had dropped subscriptions in the past 12 months, 46% of respondents in the October survey had dropped subscriptions in the past six months. In other words, people are changing services more fluidly than before.

Of those who terminated their service in the current pandemic, 62% signed up to watch a particular program and subsequently cancelled. Another 43% cancelled on the day they decided they no longer needed that service. The Wolfwalkers' scenario turned out to be quite common.

This obviously poses a problem for companies that spend huge amounts of money on content creation and acquisition, as well as advertising: according to a Deloitte study, it can cost as much as $200 per year in marketing to acquire one subscriber. To recoup that cost, a subscriber must be retained for up to 15 months. If a subscriber drops out after just one viewing of a program, that's a big loss.

Consumers are also under financial pressure: covid is hitting household budgets (although, according to Deloitte, this burden is decreasing with the passage of the pandemic). This pressure may be a contributing factor to the cancellations. It may also help explain the growing popularity of free, ad-supported streaming services such as ViacomCBS' Pluto TV and The Roku Channel.

Use of free streaming services grew rapidly in 2020: in January, 40% of consumers subscribed to at least one; in October, 60% did. Last year, NBCUniversal's Peacock was launched and garnered a lot of attention, but this service has a free tier. The report notes that these services have far less advertising per hour than pay-per-view channels, making them more attractive to viewers

.

Pricing is becoming an important factor in consumers' ability to juggle multiple subscriptions. Twenty-eight percent of respondents said they would stay with a service if they could switch to a lower-cost, ad-supported service.

Content also remains important. In response to the same question, 27% said they would "stay to see exclusive new movies or series that interest me," and 23% would like the option to "purchase new movies the same day they are released in theaters."

Of course, the major streaming distributors continue to invest vast resources in original programming; Netflix just announced its 2021 programming slate promising new releases every week, Disney recently announced at its Investor Day about 80 exclusive content "Disney +" and HBO Max is getting all of Warner Bros.' 2021 features on the same day as their theatrical release. HBO Max is also getting all of Warner Bros.' 2021 features at the same time they are released theatrically. At the same time, these contents are not only competing with each other, but are also increasingly competing with gaming and social media.

Deloitte concludes that the streaming wars are increasingly focused on other areas. Content remains king, but cost may be the new queen." "We suggest that tiered pricing combined with more sophisticated use of the data that streaming uniquely provides will allow companies to acquire and retain customers more effectively. Additional benefits such as exclusive distribution or discounts on other services would also be useful.

The overarching takeaway from this report is that, so far, it is consumers who are winning the streaming wars.

.

Post your comment